Telephone (714) 543-3338

Fax (714) 542-3338

Email info@nannitax.com

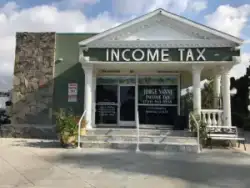

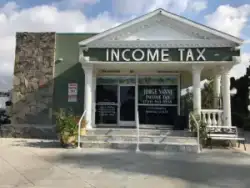

Jorge Nanni Income Tax Service Santa Ana, California

Welcome to J Nanni Income Tax Service. We have been in practice since 1980, are family-owned, and have operated from the same location since 1985, in the center of Orange County and the heart of Santa Ana. We have helped and served someone from every state in America, as well as troops overseas in Afghanistan and oil drillers in Dubai. Our services are available to all, both in English and Spanish.

We are CTEC and PTIN certified and have met the yearly training hours required by the IRS to renew our licenses.

Please check out the services we offer, and pay us a visit! We’d love to assist you!

Services

Tax Services

Short form and long form

Business

Year-round support

Correspondence and audit assistance

E-file

Immigration Services

Family petitions

Adjustment of status

Naturalizations

Lost green cards

Travel permits

Translation of Spanish language documents

Visa packets

Affidavits of support

Your Visit

Your first visit

If this is your first time visiting us, please bring a copy of your Social Security card, as well as copies of the cards of any dependents you will be claiming on your tax return.

New dependents

If you have been with us before but need to add new dependents, please bring a copy of their Social Security card(s).

Direct deposit

If you would like your tax refund deposited directly to your checking account, please bring a voided blank check. The routing number and account number are on the bottom of the check.

Wait times

Wait times are based on client volume (we do not take appointments due to high volume), so please bring a good book to pass the time, or if you bring a laptop or tablet, please remember to bring and wear headphones as a courtesy to others, thank you!

Forms (please bring all that apply)

W-2 wages

W-2G gambling winnings

1098 mortgage interest

1098-T education tuition (if you went to college, you MUST bring this form)

1098-E student loans

1099-MISC self employment

1099-INT bank interest=

1099-B capital gains (cost basis, date of purchase, sold date, and amount sold/quantity are needed)

1099-G unemployment/refund from the state

1099-C cancelation of debt

1099-DIV

1099-R retirement pension

1099-S gross proceeds from house being sold

Alimony

Babysitter/Daycare information (address, phone number, SSN and/or Federal ID number, and amounts paid are needed)

Business expenses that are ordinary, necessary, and unreimbursed

Donations

K-1 cooperation summary/merchant card and 3rd party

Property tax forms

Rental expenses/income

Social security

Student loans

Testimonials

I hope your day was meaningful and filled with love. I spent a beautiful day with my three blessings—just as I had hoped—sharing meals at our favorite spots, laughing over games at the arcade, and enjoying intentional, heart-filled time together. It was a gift to simply be present with them.

I want you to know how much I appreciate you. It’s an honor to stand alongside you as a father who is faithful, involved, and committed. Your example encourages me, and I’m grateful to journey in fatherhood with you, men of purpose, integrity, and grace.

I’m also reminded of how blessed I am to walk this journey with you, a brother who strives to lead with love, who stands firm in truth, who serves his family with courage, humility, and strength. Your encouragement, your example, and your faith inspire me to keep pressing forward in love and purpose.

May we continue to sharpen one another and remain steadfast in the work God has entrusted to us—as fathers, as men, and as vessels of His Spirit.

I am so appreciative of the work you do for me, Tammy, and the family. Please know that your care and professionalism are real, powerful, and appreciated

Adrian A. M.

FAQ's

Frequently Asked Questions - Income Tax Service

Bring the following:

Personal info: Social Security numbers for you, spouse, and dependents

Income forms: W-2s, 1099s, investment income, unemployment income, etc.

Deductions: Mortgage interest, property taxes, charitable donations, medical expenses

Credits: Childcare expenses, education forms (1098-T), IRS letters

Previous year’s tax return (optional but helpful)

No, it’s not legally required to use a certified tax preparer to file your taxes. However, using an IRS-registered or credentialed preparer like an Enrolled Agent (EA), CPA, or tax attorney ensures your return is accurate and can help you avoid audits or penalties. Certified preparers also have a PTIN (Preparer Tax Identification Number) issued by the IRS.

Credentials

Jorge Nanni

PTIN: P00107297

CTEC: A007362

Adele Nanni

PTN: P01295662

CTEC: A007381

Yes, experienced tax preparers can identify deductions and credits you might miss, helping you maximize your refund. However, be cautious of anyone who guarantees a big refund or bases their fee on a percentage of your refund—it may be a red flag.

Articles of Interest

JORGE NANNI INCOME TAX SERVICES

521 S. Broadway St.

Santa Ana, Ca. 92701

Telephone 714-543-3338

Fax 714-542-3338

Email Address info@nannitax.com

LOCATION MAP

OFFICE HOURS

Tax season hours

(Jan 1st – April 15th)

Monday thru Friday 9am-6pm

Saturday 8am-1pm

Sunday closed

Closed on holidays

Off season hours

(April 16th – December 31st)

Monday thru Wednesday 10am-5pm

Thursday thru Sunday closed

Closed on holidays

Telephone (714) 543-3338

Fax (714) 542-3338

Email info@nannitax.com

Jorge Nanni Income Tax Service Santa Ana, California

Welcome to J Nanni Income Tax Service. We have been in practice since 1980, are family-owned, and have operated from the same location since 1985, in the center of Orange County and the heart of Santa Ana. We have helped and served someone from every state in America, as well as troops overseas in Afghanistan and oil drillers in Dubai. Our services are available to all, both in English and Spanish.

We are CTEC and PTIN certified and have met the yearly training hours required by the IRS to renew our licenses.

Please check out the services we offer, and pay us a visit! We’d love to assist you!

Services

Tax Services

Short form and long form

Business

Year-round support

Correspondence and audit assistance

E-file

Immigration Services

Family petitions

Adjustment of status

Naturalizations

Lost green cards

Travel permits

Translation of Spanish language documents

Visa packets

Affidavits of support

Your Visit

Your first visit

If this is your first time visiting us, please bring a copy of your Social Security card, as well as copies of the cards of any dependents you will be claiming on your tax return.

New dependents

If you have been with us before but need to add new dependents, please bring a copy of their Social Security card(s).

Direct deposit

If you would like your tax refund deposited directly to your checking account, please bring a voided blank check. The routing number and account number are on the bottom of the check.

Wait times

Wait times are based on client volume (we do not take appointments due to high volume), so please bring a good book to pass the time, or if you bring a laptop or tablet, please remember to bring and wear headphones as a courtesy to others, thank you!

Forms (please bring all that apply)

W-2 wages

W-2G gambling winnings

1098 mortgage interest

1098-T education tuition (if you went to college, you MUST bring this form)

1098-E student loans

1099-MISC self employment

1099-INT bank interest=

1099-B capital gains (cost basis, date of purchase, sold date, and amount sold/quantity are needed)

1099-G unemployment/refund from the state

1099-C cancelation of debt

1099-DIV

1099-R retirement pension

1099-S gross proceeds from house being sold

Alimony

Babysitter/Daycare information (address, phone number, SSN and/or Federal ID number, and amounts paid are needed)

Business expenses that are ordinary, necessary, and unreimbursed

Donations

K-1 cooperation summary/merchant card and 3rd party

Property tax forms

Rental expenses/income

Social security

Student loans

Testimonials

I hope your day was meaningful and filled with love. I spent a beautiful day with my three blessings—just as I had hoped—sharing meals at our favorite spots, laughing over games at the arcade, and enjoying intentional, heart-filled time together. It was a gift to simply be present with them.

I want you to know how much I appreciate you. It’s an honor to stand alongside you as a father who is faithful, involved, and committed. Your example encourages me, and I’m grateful to journey in fatherhood with you, men of purpose, integrity, and grace.

I’m also reminded of how blessed I am to walk this journey with you, a brother who strives to lead with love, who stands firm in truth, who serves his family with courage, humility, and strength. Your encouragement, your example, and your faith inspire me to keep pressing forward in love and purpose.

May we continue to sharpen one another and remain steadfast in the work God has entrusted to us—as fathers, as men, and as vessels of His Spirit.

I am so appreciative of the work you do for me, Tammy, and the family. Please know that your care and professionalism are real, powerful, and appreciated

Adrian A. M.

FAQ's

Frequently Asked Questions - Income Tax Service

Bring the following:

Personal info: Social Security numbers for you, spouse, and dependents

Income forms: W-2s, 1099s, investment income, unemployment income, etc.

Deductions: Mortgage interest, property taxes, charitable donations, medical expenses

Credits: Childcare expenses, education forms (1098-T), IRS letters

Previous year’s tax return (optional but helpful)

No, it’s not legally required to use a certified tax preparer to file your taxes. However, using an IRS-registered or credentialed preparer like an Enrolled Agent (EA), CPA, or tax attorney ensures your return is accurate and can help you avoid audits or penalties. Certified preparers also have a PTIN (Preparer Tax Identification Number) issued by the IRS.

Credentials

Jorge Nanni

PTIN: P00107297

CTEC: A007362

Adele Nanni

PTN: P01295662

CTEC: A007381

Yes, experienced tax preparers can identify deductions and credits you might miss, helping you maximize your refund. However, be cautious of anyone who guarantees a big refund or bases their fee on a percentage of your refund—it may be a red flag.

JORGE NANNI INCOME TAX SERVICES

521 S. Broadway St. Santa Ana, Ca. 92701

Telephone 714-543-3338

Fax 714-542-3338

Email Address info@nannitax.com

LOCATION MAP

OFFICE HOURS

Tax season hours

(Jan 1st – April 15th)

Monday thru Friday 9am-6pm

Saturday 8am-1pm

Sunday closed

Closed on holidays

Off season hours

(April 16th – December 31st)

Monday thru Wednesday 10am-5pm

Thursday thru Sunday closed

Closed on holidays

CREDENTIALS

Jorge Nanni

PTIN: P00107297

CTEC: A007362

Adele Nanni

PTN: P01295662

CTEC: A007381